October 2016

THIS MONTH: |

|

| October 1st SIMPLE IRA plan establishment due |

|

| October 15th Extension tax return filing deadline |

|

| October 31st Halloween |

|

In this issue:

As fall approaches, the election cycle seems to be putting a freeze on any new tax legislation. This is good news for 2016 tax planning. Included this month is estimated tax information for 2017 based upon the Consumer Price Index. There are also articles on recovering from identity theft and how to save money from long-time suppliers of services rounds out this month’s newsletter.

Preview of Some Key 2017 Tax Figures

While official numbers for 2017 are not yet released by the Internal Revenue Service (IRS), many figures are based on the Consumer Price Index (CPI) published by the Department of Labor. Using the release of recent CPI figures, a number of sources are projecting key figures for 2017.

While official numbers for 2017 are not yet released by the Internal Revenue Service (IRS), many figures are based on the Consumer Price Index (CPI) published by the Department of Labor. Using the release of recent CPI figures, a number of sources are projecting key figures for 2017.

Tax Brackets: While the actual income brackets for tax rates are not set for 2017, the rate of inflation impacting the income levels for each rate is anticipated to raise the income brackets by approximately 0.6 – 0.8%.

Personal Exemption: $4,050 in 2017 (unchanged from 2016)

Standard Deductions:

| Deduction | Tax Year 2017 | Tax Year 2016 |

| Single |

$6,350

|

$6,300

|

| Head of Household |

$9,350

|

$9,300

|

| Married Filing Jointly |

$12,700

|

$12,600

|

| Married Filing Separately |

$6,350

|

$6,300

|

| Dependents (kiddie tax) |

$1,050

|

$1,050

|

| 65 or Blind: Married |

Add $1,250

|

Add $1,250

|

| Single |

Add $1,550

|

Add $1,550

|

Other Key figures:

| Estate & Gift Tax Exclusion |

$5.49 million

|

$5.45 million

|

| Annual Gift Tax Exclusion |

$14,000

|

$14,000

|

| Roth and Traditional IRA Contribution Limit |

$5,500

|

$5,500

|

Caution: Remember, these are early figures using the recently announced Consumer Price Index. Official numbers are released by the IRS later in the year.

Recovering from Identity Theft

There are now millions of victims of the identity theft epidemic. From stolen credit cards to fraudulently filed tax returns, a vast swath of the U.S. is trying to figure out how to repair the damage. To help, the Federal Trade Commission has created a nice tool to work through the recovery process.

The site: IdentityTheft.gov

The site: IdentityTheft.gov

Caution: Do not confuse this site with IdentityTheft.com or .org

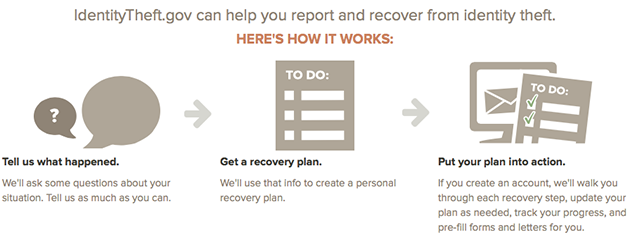

The Process: The site will walk you through a step-by-step approach to report and repair your damage. There are different paths depending on the type of identity theft you have been subjected to.

Here is a snapshot of the Federal Trade Commission’s recovery process.

Everyone should review the site. Even if you are not currently a victim of identity theft, spend a few minutes reviewing the site. A review now can help you become more aware of the problem and help you understand what immediate steps you should take if this happens to you.

Stop Price Creep

Review your household vendors

One simple idea could save you hundreds in your monthly expenses. It has to do with the tendency for inertia. When you are looking for a supplier of basic services, you tend to shop alternative companies, ask friends for recommendations, and get quotes from alternate choices. After completing this often exhausting work, you sit back and enjoy your new supplier.

The problem. Once a supplier is chosen, review of the service is often not redone. Unfortunately, things change and what was once a good deal can become a very expensive proposition.

The problem. Once a supplier is chosen, review of the service is often not redone. Unfortunately, things change and what was once a good deal can become a very expensive proposition.

Example, talk about trash. A young couple move into a new home. They shop and hire a trash collector. Over the years, the trash collector is purchased by a new hauler and the new hauler merges with another hauler a couple of years later. One day their supplier-provided trash can disappears. When looking online for the phone number to request a replacement, the couple discovers a listed price for their service much lower than what they are paying. Their $28 per month fee is offered to new customers for $10 per month.

What to do. Every two or three years conduct a review of your suppliers. To keep the process manageable, rotate a few vendors each year for this review exercise. The longer you use a supplier without a review, the more important the review becomes. Here are some common culprits for price creep:

- Cell phone providers

- Cable services

- Internet services

- Auto insurance

- Health insurance

- Trash collectors

- Homeowner insurance

- Cleaning services

It is not only price. Remember, just because your supplier is not the lowest price, there may be other reasons to continue your service. Trust and quality of service should also be considered in your decision making process.