2020 is coming quick — are you prepared? Take stock now and learn about the year-end moves that’ll help you save. Plus, consider how the 2020 Social Security changes will affect your plans. And make sure you’re hitting the employment tax deadlines.

IN THIS ISSUE:

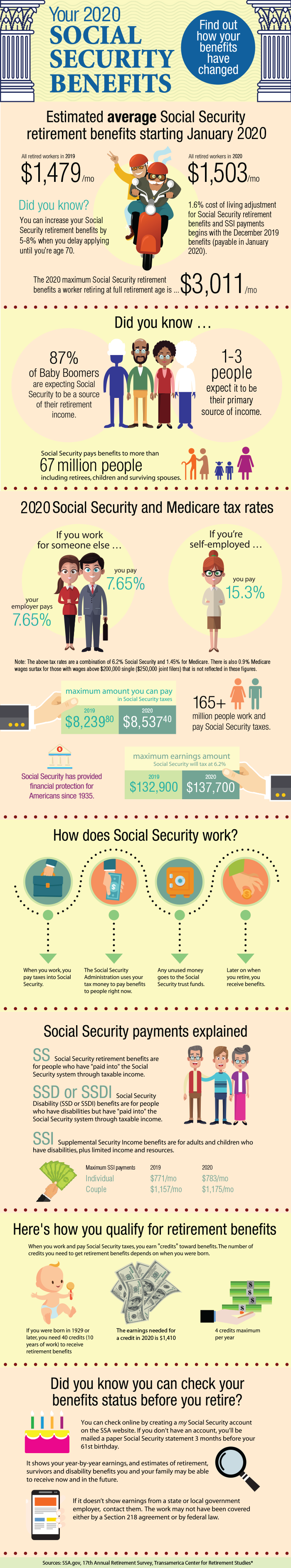

2020 Social Security Benefits

Take a look at how Social Security benefits have changed. Use this infographic to help you plan for the coming year, and to learn a little more about retirement benefits and taxes.

Reminder: Major Employment Tax Deadlines

Handling employment taxes can be complicated, especially when you’re required to file important tax documents throughout the year. Here’s a list of key forms and deadline dates to help keep you on track.

The Power of Cultivating Gratitude

Tips on how to be thankful

It costs nothing to say thank you. Yet cultivating gratitude in your life may be one of the most rewarding moves you can make. Not only does it invoke warm fuzzies in everyone involved, expressing your appreciation may actually improve your health and well-being.

Tips to Improve Your Credit Score

Your credit score is more important than ever. Once viewed as a necessity when applying for a mortgage, it now factors into renting an apartment, paying for utilities, buying a cell phone, and determining the amount you pay for home and auto insurance! Here are tips to help you improve and maintain a good credit score:

2020 Social Security Benefits

Take a look at how Social Security benefits have changed. Use this infographic to help you plan for the coming year, and to learn a little more about retirement benefits and taxes.

Reminder: Major Employment Tax Deadlines

Handling employment taxes can be complicated, especially when you’re required to file important tax documents throughout the year. Here’s a list of key forms and deadline dates to help keep you on track.

Form 941 — Employer’s quarterly federal tax return

This form is used to report income tax withheld from employees’ pay and both the employer’s and employees’ share of Social Security and Medicare taxes.

Employers generally must deposit Form 941 payroll taxes on either a monthly or semiweekly deposit schedule. There are exceptions if you owe $100,000 or more on any day during a deposit period, if you owe $2,500 or less for the calendar quarter, or if your estimated annual payroll tax liability is $1,000 or less.

![]() Monthly depositors are required to deposit payroll taxes accumulated within a calendar month by the 15th of the following month.

Monthly depositors are required to deposit payroll taxes accumulated within a calendar month by the 15th of the following month.

![]() Semiweekly depositors generally must deposit payroll taxes on Wednesdays or Fridays, depending on when wages are paid.

Semiweekly depositors generally must deposit payroll taxes on Wednesdays or Fridays, depending on when wages are paid.

Return filing deadlines:

![]() Jan. 31, 2020 – Due date for filing Form 941 for the fourth quarter of 2019. If you deposited your taxes in full and on time, you have until Feb. 10, 2020, to file this return.

Jan. 31, 2020 – Due date for filing Form 941 for the fourth quarter of 2019. If you deposited your taxes in full and on time, you have until Feb. 10, 2020, to file this return.

![]() April 30, 2020 – Due date for filing Form 941 for the first quarter. If you deposited your taxes in full and on time, you have until May 11, 2020, to file this return.

April 30, 2020 – Due date for filing Form 941 for the first quarter. If you deposited your taxes in full and on time, you have until May 11, 2020, to file this return.

![]() July 31, 2020 – Due date for filing Form 941 for the second quarter. If you deposited your taxes in full and on time, you have until Aug. 10, 2020, to file this return.

July 31, 2020 – Due date for filing Form 941 for the second quarter. If you deposited your taxes in full and on time, you have until Aug. 10, 2020, to file this return.

![]() Nov. 1, 2020 – Due date for filing Form 941 for the third quarter. If you deposited your taxes in full and on time, you have until Nov. 10 to file this return.

Nov. 1, 2020 – Due date for filing Form 941 for the third quarter. If you deposited your taxes in full and on time, you have until Nov. 10 to file this return.

Form 940 — Employer’s annual federal unemployment tax return (FUTA)

This return is due annually. However, FUTA tax must generally be deposited once a quarter if the accumulated tax exceeds $500.

![]() Jan. 31, 2020 – Due date for filing 2019 Form 940. If you deposited your taxes in full and on time, you have until Feb. 10, 2020, to file this return. This day is also the deadline for depositing federal unemployment tax for October, November and December 2019.

Jan. 31, 2020 – Due date for filing 2019 Form 940. If you deposited your taxes in full and on time, you have until Feb. 10, 2020, to file this return. This day is also the deadline for depositing federal unemployment tax for October, November and December 2019.

![]() April 30, 2020 – Deadline for depositing federal unemployment tax for January, February and March 2020.

April 30, 2020 – Deadline for depositing federal unemployment tax for January, February and March 2020.

![]() July 31, 2020 – Deadline for depositing federal unemployment tax for April, May and June 2020.

July 31, 2020 – Deadline for depositing federal unemployment tax for April, May and June 2020.

![]() Nov. 1, 2020 – Deadline for depositing federal unemployment tax for July, August and September 2020.

Nov. 1, 2020 – Deadline for depositing federal unemployment tax for July, August and September 2020.

Form W-2 — Wage and tax statement

Employers are required to send this document to each employee and the IRS at the end of the year. It reports employee annual wages and taxes withheld from paychecks.

![]() Jan. 31, 2020 – Due date for employers to provide 2019 Forms W-2 to employees, and for employers to send copies of 2019 W-2s to the Social Security Administration, whether filing electronically or with paper forms.

Jan. 31, 2020 – Due date for employers to provide 2019 Forms W-2 to employees, and for employers to send copies of 2019 W-2s to the Social Security Administration, whether filing electronically or with paper forms.

Tax deadline extensions for disaster areas

For taxpayers living in designated disaster areas, the IRS extends certain filing and tax payment dates. Taxpayers living in the affected areas (and those whose tax professionals are located in those areas) have relief from penalties for filing under the new extended dates. These filing and payment extensions are also available to some relief workers.

Visit the IRS’s Disaster Assistance and Emergency Relief for Individuals and Businesses page for up-to-date information.

Please call for help with specific details about your filing requirements and for more information on tax deadlines that apply to your business.

The Power of Cultivating Gratitude

Tips on how to be thankful

It costs nothing to say thank you. Yet cultivating gratitude in your life may be one of the most rewarding moves you can make. Not only does it invoke warm fuzzies in everyone involved, expressing your appreciation may actually improve your health and well-being.

A landmark study by gratitude researcher Robert A. Emmons has shown that gratitude can reduce physical illness symptoms and toxic emotions. It can even help you sleep better and longer, according to a study published in Applied Psychology: Health and Well-Being.

So what are some ways you can make gratitude part of your everyday life? Here are a few tips to help you get started:

![]() Write it out. Write out what you’re thankful for in your life. This may mean making a nightly habit of writing in a journal or jotting down a message to a loved one and giving it to them. You could also make some sticky note reminders of what you’re grateful for and hang them on your mirror to read each morning.

Write it out. Write out what you’re thankful for in your life. This may mean making a nightly habit of writing in a journal or jotting down a message to a loved one and giving it to them. You could also make some sticky note reminders of what you’re grateful for and hang them on your mirror to read each morning.

![]() Share a good memory. Reminiscing often stirs up feelings of gratitude. For instance, think about the time you first met a close friend in grade school. Contact them and tell them how grateful you are that it happened. Send a photo of that family vacation when you all shared a common experience like learning to water ski. When you think about it, you will quickly discover happy memories to share with loved ones.

Share a good memory. Reminiscing often stirs up feelings of gratitude. For instance, think about the time you first met a close friend in grade school. Contact them and tell them how grateful you are that it happened. Send a photo of that family vacation when you all shared a common experience like learning to water ski. When you think about it, you will quickly discover happy memories to share with loved ones.

![]() Offer your service. Show your gratitude through your actions. If you appreciate your community, join a group to clean up the park and streets. Provide a positive online review for your favorite local café. Or volunteer at a Veterans Affairs hospital.

Offer your service. Show your gratitude through your actions. If you appreciate your community, join a group to clean up the park and streets. Provide a positive online review for your favorite local café. Or volunteer at a Veterans Affairs hospital.

![]() Lend an ear. Some of the most meaningful moments involve simply being heard. Return the favor. If your sister is usually the one who lets you ramble on about work grievances and family drama, it’s time to give her a turn. Let her know you’re there and ready to listen. Maybe you avoid your chatty (albeit helpful) coworker. When you see them next, give them 5 minutes of your time.

Lend an ear. Some of the most meaningful moments involve simply being heard. Return the favor. If your sister is usually the one who lets you ramble on about work grievances and family drama, it’s time to give her a turn. Let her know you’re there and ready to listen. Maybe you avoid your chatty (albeit helpful) coworker. When you see them next, give them 5 minutes of your time.

![]() Pay it forward. Did your neighbor share a gutter-cleaning hack with you? Next time you see someone on your street cleaning their gutters, offer to lend a hand. See a mom digging for spare change at a check out register? Pay it for her. Let the appreciation of your good deed change someone else’s outlook for the day. When they offer to pay you back, just tell them to pay it forward.

Pay it forward. Did your neighbor share a gutter-cleaning hack with you? Next time you see someone on your street cleaning their gutters, offer to lend a hand. See a mom digging for spare change at a check out register? Pay it for her. Let the appreciation of your good deed change someone else’s outlook for the day. When they offer to pay you back, just tell them to pay it forward.

There are opportunities to cultivate gratitude all around us. Refocusing on what you appreciate on regular basis can help you live a healthier, more satisfying life.

Tips to Improve Your Credit Score

Your credit score is more important than ever. Once viewed as a necessity when applying for a mortgage, it now factors into renting an apartment, paying for utilities, buying a cell phone, and determining the amount you pay for home and auto insurance! Here are tips to help you improve and maintain a good credit score:

![]() Know which bills must be paid on time. One bill that goes more than 30 days past its due date can drop your credit score 40 points and can stay on your credit report for seven years! If you are in a cash pinch and can’t pay all your bills on time, prioritize mortgage, car loan and credit card bills that report late payments to credit agencies. Utilities and medical organizations generally don’t report a delinquency until your account is sent to a collection agency.

Know which bills must be paid on time. One bill that goes more than 30 days past its due date can drop your credit score 40 points and can stay on your credit report for seven years! If you are in a cash pinch and can’t pay all your bills on time, prioritize mortgage, car loan and credit card bills that report late payments to credit agencies. Utilities and medical organizations generally don’t report a delinquency until your account is sent to a collection agency.

![]() Watch revolving credit balances. Each credit card has a credit ceiling. This credit limit is compared to how much of it you use. The higher amount of the credit limit you use, the lower your credit score. Even if you pay the bill in full each month! Ideally, try to keep the spending balance less than 20 percent of your credit limit. If your routine spending is higher than this, consider requesting a higher line of credit, but do not use it. The sole purpose of this request is to create a higher credit score.

Watch revolving credit balances. Each credit card has a credit ceiling. This credit limit is compared to how much of it you use. The higher amount of the credit limit you use, the lower your credit score. Even if you pay the bill in full each month! Ideally, try to keep the spending balance less than 20 percent of your credit limit. If your routine spending is higher than this, consider requesting a higher line of credit, but do not use it. The sole purpose of this request is to create a higher credit score.

![]() Pay off debt. Current debt balances account for as much as 30 percent of your credit score. When you consider this and the high interest rates that come with debt, it’s important to get those balances to zero as soon as possible. Your debt-to-income ratio (total debt divided by your total income) doesn’t directly affect your credit score, but it’s a key metric used by underwriters when determining loan eligibility and interest rates.

Pay off debt. Current debt balances account for as much as 30 percent of your credit score. When you consider this and the high interest rates that come with debt, it’s important to get those balances to zero as soon as possible. Your debt-to-income ratio (total debt divided by your total income) doesn’t directly affect your credit score, but it’s a key metric used by underwriters when determining loan eligibility and interest rates.

![]() Add new debt only when necessary. Adding new debt can reduce your credit score in a few different ways: your debt profile increases, your debt-to-income ratio rises, and even the credit inquiry itself can take a chunk out of your score. If you have a relatively short credit history, too many credit inquires will affect you even more.

Add new debt only when necessary. Adding new debt can reduce your credit score in a few different ways: your debt profile increases, your debt-to-income ratio rises, and even the credit inquiry itself can take a chunk out of your score. If you have a relatively short credit history, too many credit inquires will affect you even more.

![]() Consider keeping dormant credit cards open. Have an open credit card that you’ve paid off or have never used? Your instinct might tell you to close the account, but keeping it open may actually help your credit score. An active credit card in good standing for a long period of time helps your credit score. Plus, the additional unused credit limit on your books lowers the ratio of spending to total credit limit and improves your score.

Consider keeping dormant credit cards open. Have an open credit card that you’ve paid off or have never used? Your instinct might tell you to close the account, but keeping it open may actually help your credit score. An active credit card in good standing for a long period of time helps your credit score. Plus, the additional unused credit limit on your books lowers the ratio of spending to total credit limit and improves your score.

![]() Actively monitor your credit reports. You can get a free credit report from each reporting agency every 12 months on the Annual Credit Report website. These reports tell you everything you need to know about items impacting your credit score. Reviewing these items on a routine basis is an important exercise to ensure a correct report. If you find a mistake, you can work to get it removed and improve your score.

Actively monitor your credit reports. You can get a free credit report from each reporting agency every 12 months on the Annual Credit Report website. These reports tell you everything you need to know about items impacting your credit score. Reviewing these items on a routine basis is an important exercise to ensure a correct report. If you find a mistake, you can work to get it removed and improve your score.

Your credit score is too important to ignore. Taking an active role by implementing some of these smart tactics is a great way to improve your score and overall credit health.