THIS MONTH:

|

November 11th

Veterans Day |

|

|

November 26th

Thanksgiving |

|

|

November 27th

Black Friday |

|

|

Reminder

Conduct year-end tax and financial planning |

With all the talk during the pandemic to save money, it is possible to go too far. Included here are some ideas to make sure this does not happen to you. The Social Security Administration recently announced its 2021 cost of living adjustments. More wages will be taxed and retirement checks will go up. The annual details and some interesting Social Security information are outlined here. And if your small business is struggling on how to make ends meet during this challenging time, here are some hints to effectively price your products. All this and some handy every-day tips EVERYONE should know.

IN THIS ISSUE:

Saving Too Much Can Sometimes Be Expensive

When it comes to money topics, you’re always hearing how to save more. But even with the best of intentions, you can run into trouble when you try to save too much. Here are four ways that savings can get in your way and how you can correct them.

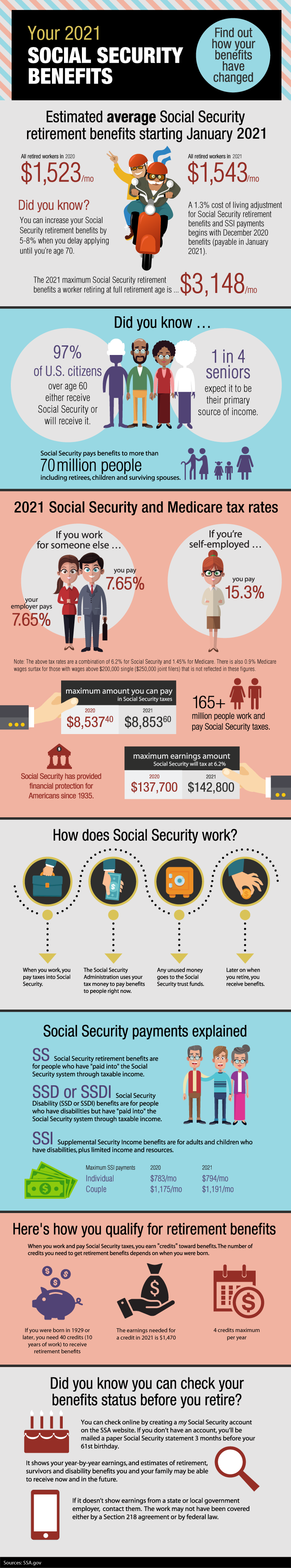

Social Security Benefits Increase in 2021

Find out how your benefits have changed.

Everyday Tips For Easier Living!

Too often you find yourself in a situation and aren’t sure what to do. Here are some everyday tips that could come in handy!

How to Walk the Tightrope When Raising Prices

Raising prices can be fraught with risk during good economic times. So what happens if you try to raise prices during bad economic times?

Saving Too Much Can Sometimes Be Expensive

When it comes to money topics, you’re always hearing how to save more. But even with the best of intentions, you can run into trouble when you try to save too much. Here are four ways that savings can get in your way and how you can correct them.

When it comes to money topics, you’re always hearing how to save more. But even with the best of intentions, you can run into trouble when you try to save too much. Here are four ways that savings can get in your way and how you can correct them.

Savings that turns into spending. Buying something on sale to save money is still spending. Focus on the amount of money you have to part with, instead of focusing on the great deal. These deals use the human emotion of the fear of losing out, causing you to spend money you did not plan on spending in the first place.

What you can do: Plan your purchases. If something on your list of planned purchases is then on sale, you will truly be saving money. So instead of saving 50% on a new lawn mower, save 100% because you already have one that works just fine.

Savings that turns into hoarding. This could happen if you have a hard time parting with things for fear you might be able to use it in the future. This could be as simple as buying a new set of dishes or a new pair of shoes and hanging on to the old ones just in case. Each time you acquire something new without throwing out the old, your house gets stuffed with items you don’t need.

What you can do: When you need to replace something, try to sell the old item right after bringing in the new item(s). Not only will this keep the clutter out of your home, it will effectively lower the cost of the replacement. And periodically review the contents of your household. Have you used it in the last 12 months? If not, chances are good that you won’t need it in the foreseeable future.

Not replacing things when you should. This savings behavior might actually be costing you money. For example, that old water heater still works, but it could be so inefficient that it is costing a ton in excess electricity or gas. The same could be true with an old car’s maintenance bills or even wearing clothes even though you’ve worn holes in them.

What you can do: Consider replacements as investments. For instance, replacing the old brakes in your car is an investment in your safety. Replacing your worn out shoes is an investment in your comfort. Replacing your toothbrush that is falling apart is an investment in your health.

Risking damages or dangers. It’s great to save money by doing something by yourself, but know your limits. Sure, cutting down that old tree by yourself can save you a ton of money. But the emergency room is full of do-it-yourself savers who lack the experience to do it safely. The same can be true with making financial decisions or even wading through the tax code on your own.

What you can do: Know your limits and ask for help. Sometimes paying a little more is worth it if it means avoiding a potentially dangerous or financially negative situation.

Social Security Benefits Increase in 2021

Everyday Tips For Easier Living!

Too often you find yourself in a situation and aren’t sure what to do. Here are some everyday tips that could come in handy!![]()

Chew the aspirin. Taking an aspirin at the outset of a heart attack could save a life. But for an aspirin to save your life during a heart attack, you need to chew it. Aspirin, which inhibits platelets that speed blood clots, works fastest if chewed.

![]() Celsius to Fahrenheit conversion: Degrees in Celsius x 1.8 plus 32. Only 5 countries measure temperature using Fahrenheit, so it is good to know how to convert from one to another. C to F: Take the temperature times 1.8 and add 32. F to C: Reverse the math. Subtract 32, then divide by 1.8.

Celsius to Fahrenheit conversion: Degrees in Celsius x 1.8 plus 32. Only 5 countries measure temperature using Fahrenheit, so it is good to know how to convert from one to another. C to F: Take the temperature times 1.8 and add 32. F to C: Reverse the math. Subtract 32, then divide by 1.8.

![]() Cats like milk, but it often does not like them. It’s not healthy for your cat to eat or drink anything that contains dairy. Cats have a degree of lactose intolerance and can get sick from large quantities of milk.

Cats like milk, but it often does not like them. It’s not healthy for your cat to eat or drink anything that contains dairy. Cats have a degree of lactose intolerance and can get sick from large quantities of milk.

![]() Miles to kilometers? Use the 3-5 method for an approximation.

Miles to kilometers? Use the 3-5 method for an approximation.

Kilometers to Miles: Divide by 5, multiply times 3 & Miles to Kilometers: Divide by 3, multiply times 5

![]() Easily restore browser tabs. Control+Shift+T restores most closed browser tabs. Control+Alt+Shift+T restores entire closed browser windows.

Easily restore browser tabs. Control+Shift+T restores most closed browser tabs. Control+Alt+Shift+T restores entire closed browser windows.

![]() Never fear calls from the IRS. Don’t be afraid of a phone call from the IRS – because they will never call without mailing you first. If you owe money to Uncle Sam, the IRS will always initiate communication via mail.

Never fear calls from the IRS. Don’t be afraid of a phone call from the IRS – because they will never call without mailing you first. If you owe money to Uncle Sam, the IRS will always initiate communication via mail.

Should you have any questions regarding your situation, feel free to call.

How to Walk the Tightrope When Raising Prices

Raising prices can be fraught with risk during good economic times. So what happens if you try to raise prices during bad economic times?

Raising prices can be fraught with risk during good economic times. So what happens if you try to raise prices during bad economic times?

As Hamlet would say, “Ah, there’s the rub.” If you raise prices, you risk losing clients to competitors. If you don’t, decreasing revenue or rising costs can capsize your company. So what’s a small business supposed to do?

The Art of Pricing

Raising (and, sometimes, even lowering) prices can be a balancing act. As with any major business decision, pricing should take into account various factors. Here are several to consider.

Analyze costs. First, you need to carefully analyze the costs needed to bring your products or services to market. Such expenses might include raw materials, storage, personnel, advertising, delivery, rent, equipment, taxes and insurance. Failure to cover all these costs in your price will inevitably lead to shrinking profits.

Establish profit margin. Next, it’s important to establish an acceptable profit margin. This is where the art of pricing begins. To find your company’s sweet spot with regards to pricing, consider researching competitors in your region to determine their pricing for comparable products, raising your finger to the wind to discern the business climate and asking your customers about their preferences.

Listen to your customers. Your customers will tell you if you raised prices too high. They’ll either continue to buy your product or seek out a competitor.

Consider incremental price increases. Small, incremental price increases tend to be more palatable to customers than a few large changes. We see this every day in the rising cost of gasoline, utilities and taxes. Many customers can handle incremental inflation…just don’t shock them with a huge increase all at once.

When considering pricing, it’s important to take a long, hard look at both your costs and the quality of your products and services. Customers will generally pay a premium for goods and services that provide greater value. Successful business owners endeavor to increase both the actual quality of their products and the perception of that quality in the minds of customers. Do both well, and a price increase may be in order.